child tax credit portal not working

There are several functions the portal performs including enrolling in the payments opting out of the credit altogether and inputting bank account information to ensure you receive the payment via direct deposit. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

The Child Tax Credit Update Portal is no longer available.

. 2021 Child Tax Credit and Advance Payments. I cant even get into the portal it keeps saying unavailable and doesnt have my name just TAXPAYER and the little cloud crying. The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out.

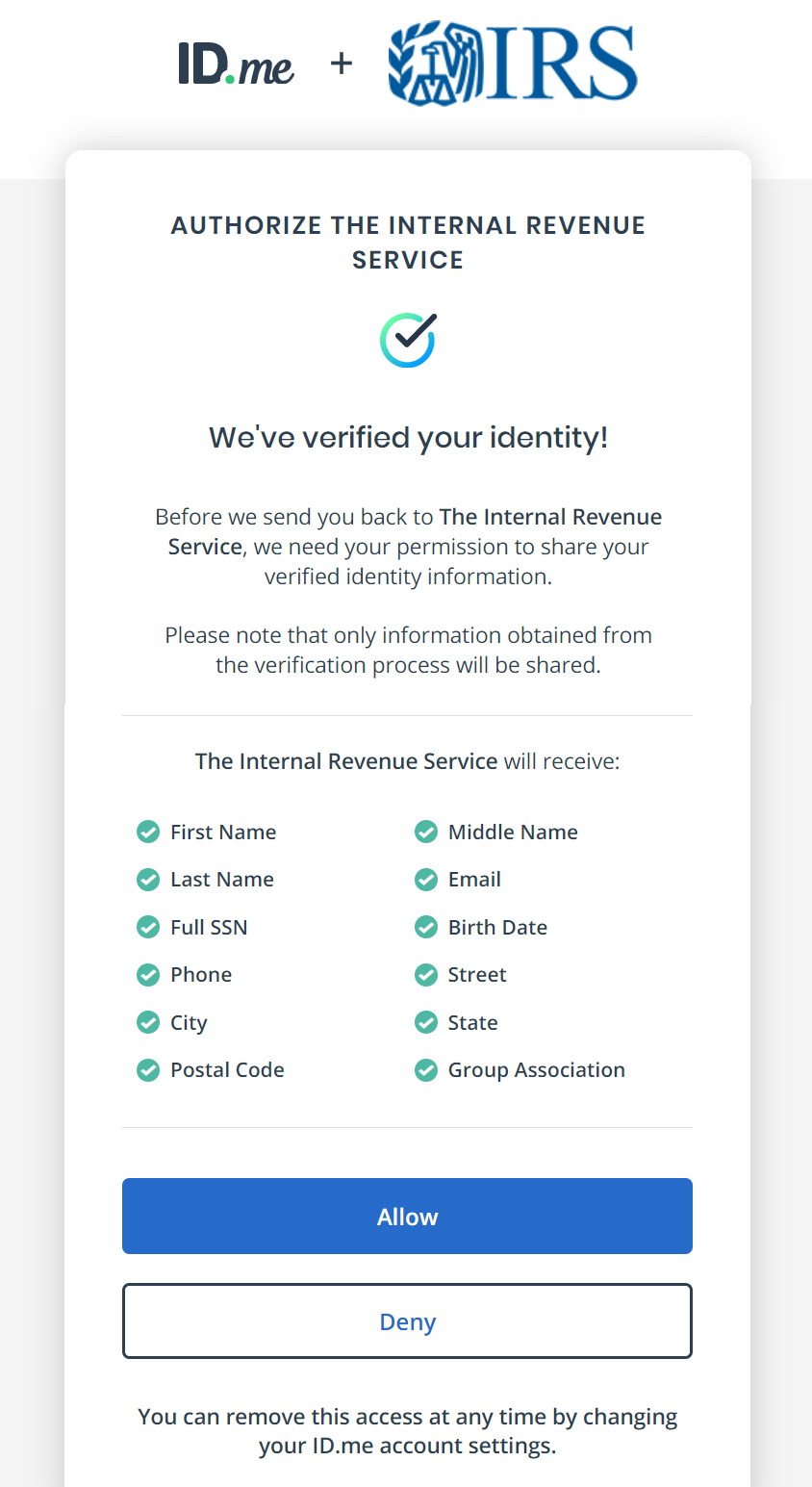

In order to sign in to any of the portals you will need to first verify your identity through IDme. How To Use The Child Tax Credit Direct Deposit Portal. File a federal return to claim your child tax credit.

You arent getting the Child Tax credit CTC. The IRS is still dealing with a backlog of tax returns and it is possible a delay in processing your tax return has caused a delay in processing your eligibility for. These people can now use the online tool to register for monthly child tax credit payments.

You do not necessarily get the maximum amount. Do not assume your refund will include 2000 per child for child tax credits. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. You can also use the portal to unenroll from receiving the monthly payments if you are not eligible or prefer to receive the full. The Child Tax Credit Update Portal allows you to verify your familys eligibility for advance payments of this tax credit and add or update a bank account to receive your payments quickly by direct deposit.

2022 Child Tax Rebate. Be your son daughter stepchild eligible foster child brother sister. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

The IRS has set up an online portal for the purposes of managing child tax credit payments. Its called the Non-filer sign-up tool which is for people who did NOT we repeat DID NOT file their 2020 taxes which would have been done in 2021. The IRS will pay 3600 per child to parents of young children up to age five.

The amount you can get depends on how many children youve got and whether youre. Be under age 18 at the end of the year. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

The CTC is used first to reduce your tax liability to zero. The IRS has partnered with the third-party company to verify identities before allowing access to the portals. To be a qualifying child for the 2021 tax year your dependent generally must.

After that there is a refundable portion called the Additional Child Tax Credit that is calculated based on the amount of income you earned. Half of the money will come as six monthly payments and. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Get help dealing with the IRS on a variety of tax problems including back taxes tax notices property liens and levies. Simple or complex always free.

Child Tax Credit portal not working. In order to sign in to any of the portals you will need to first verify your identity through IDme. Already claiming Child Tax Credit.

Updated on 72121. The Child Tax Credit helps all families succeed. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit.

Posted by 2 months ago. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. Child Tax Credit portal not working.

You get 15 of the. I cant even get into the. It does not work that way.

And towards the end of this post we will walk through step-by-step what you need in order to. Making a new claim for Child Tax Credit. The Child Tax Credit provides money to support American families helping them make ends meet.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Pin By The Taxtalk On Income Tax In 2021 Tax Refund Income Tax Chartered Accountant

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Quicko Gst Tax Credits Tax Income Tax

Decode Budget Compare To New Ay Income Tax Budgeting Income

Gst Return Form Portal Live On Form

Handle Income Tax Scrutiny Cases Chartered Accountant Business Intelligence Classical Latin

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Check Supplier Gst Status Status Tax Credits Tax Payment

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Did Your Advance Child Tax Credit Payment End Or Change Tas

Easy Steps To Enroll Digital Signature Certificate On New Tax 2 0 Portal Government Portal Tax Software Digital Signature

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet